Gold has always been synonymous with wealth and financial stability. In times of economic uncertainty, investors often turn to precious metals as a reliable store of value. Among these, bullion bars stand out as one of the most straightforward and effective ways to invest in gold. This article explores the appeal of gold bullion bars, their advantages, and how to make informed decisions when adding them to your investment portfolio.

What Are Bullion Bars?

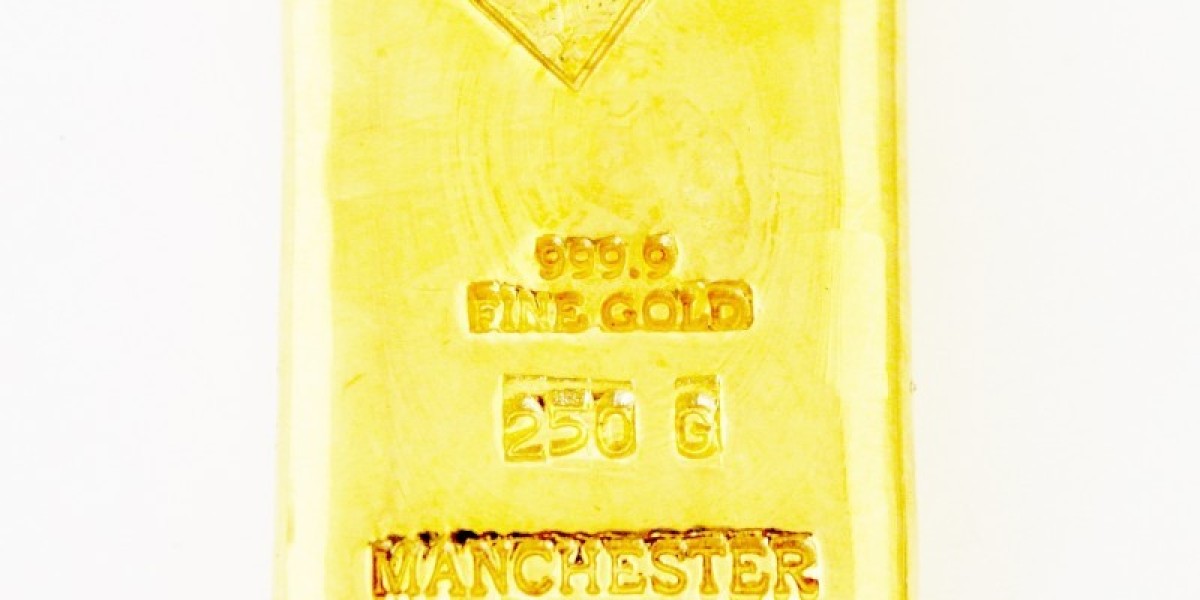

Bullion bars, commonly referred to simply as gold bars, are blocks of pure gold produced by private mints or government refineries. They come in various sizes, typically ranging from as small as 1 gram bullion bars to as large as 1 kilogram or even heavier. The purity of these bars is usually very high, often 99.99% pure gold, also known as 24-karat gold.

Why Invest in Bullion Bars?

High Purity: Bullion bars are renowned for their high purity levels. Most are 99.99% pure, which means they contain very few impurities. This high purity makes them a preferred choice for investors looking to own the metal itself.

Cost-Effective: Compared to gold coins, bullion bars usually have lower premiums over the spot price of gold. This makes them a cost-effective option for those looking to maximize their investment in gold.

Scalability: Bullion bars come in a wide range of sizes. This scalability allows investors to purchase gold according to their budget and investment goals, from small bars for beginners to larger bars for seasoned investors.

Storage and Transport: The uniform shape and size of bullion bars make them easy to store and transport. Whether you’re storing them in a home safe or a secure vault, their design facilitates efficient stacking and handling.

Liquidity: Gold bullion bars are widely recognized and accepted globally. This makes them highly liquid assets that can be easily bought or sold in markets around the world.

How to Buy Bullion Bars

1. Educate Yourself

Before diving into the gold market, it's important to understand the factors that influence gold prices. These include economic indicators, geopolitical events, and market trends. Knowing these can help you make informed decisions about when and how much to invest.

2. Choose a Reputable Dealer

The legitimacy of your investment depends on the credibility of the dealer. Look for dealers with a solid reputation, positive customer reviews, and clear pricing policies. Accredited dealers often provide certification and documentation verifying the purity and weight of their bullion bars.

3. Select the Right Size

Decide on the size of the bullion bars based on your investment capacity and goals. Smaller bars are more affordable and easier to liquidate, while larger bars offer lower premiums per gram of gold. Diversifying the sizes can also be a strategic approach.

4. Verify Authenticity

Ensure the bullion bars come with proper authentication, such as an assay certificate. Many reputable bars also feature a serial number and the hallmark of the producing mint, which guarantees their authenticity and purity.

5. Consider Storage Solutions

Proper storage is crucial to maintaining the value of your bullion bars. Options include home safes, bank safety deposit boxes, and private vault services. Insured storage facilities offer additional security and peace of mind.

Where to Buy Bullion Bars

Online Retailers: Numerous online platforms specialize in selling gold bullion bars. These platforms offer a wide selection and competitive pricing. Ensure the retailer is reputable and provides secure payment and shipping options.

Local Dealers and Coin Shops: Purchasing from local dealers allows bullion bars you to inspect the bullion bars in person. This can provide reassurance about their authenticity and condition.

Banks and Financial Institutions: Some banks sell bullion bars and offer secure storage options. Although their selection might be limited, the added trust of a financial institution can be reassuring.

Auctions and Estate Sales: Occasionally, bullion bars are available at auctions or estate sales. These can offer unique opportunities to purchase gold at competitive prices, though they require careful verification.

Conclusion

Investing in gold bullion bars is a prudent way to safeguard and grow your wealth. With their high purity, cost-effectiveness, and liquidity, bullion bars are a solid addition to any investment portfolio. By educating yourself, choosing reputable dealers, and considering proper storage solutions, you can confidently invest in gold bullion bars and secure your financial future. Whether you're a seasoned investor or new to precious metals, bullion bars offer a tangible and reliable means of preserving and enhancing your wealth.